In today’s digital economy, many ask: what is a crypto card and why is it important? It’s a tool that links cryptocurrency to everyday payments. Instead of holding Bitcoin, USDT, or other tokens as idle assets, users can spend them directly on groceries, bills, or travel. At checkout, crypto is instantly converted into local currency, working like cash or a regular card.

Relopay offer crypto card benefits by letting users easily spend digital assets like real cash anywhere. Available in debit, credit, and prepaid formats, they adapt to different spending styles and needs.

Types of Crypto Cards

Crypto cards share one purpose — making digital assets spendable — but differ in use. The main types are debit, credit, and prepaid. Each brings crypto card benefits: debit cards link to wallets for instant use, credit cards add rewards, and prepaid cards help manage budgets. Together, they cover needs from shopping to travel.

Crypto Debit Cards

So, what is crypto debit card in practice? It links to your wallet, and when you pay, tokens convert into local currency within seconds. To the store, it looks like a normal debit card transaction.

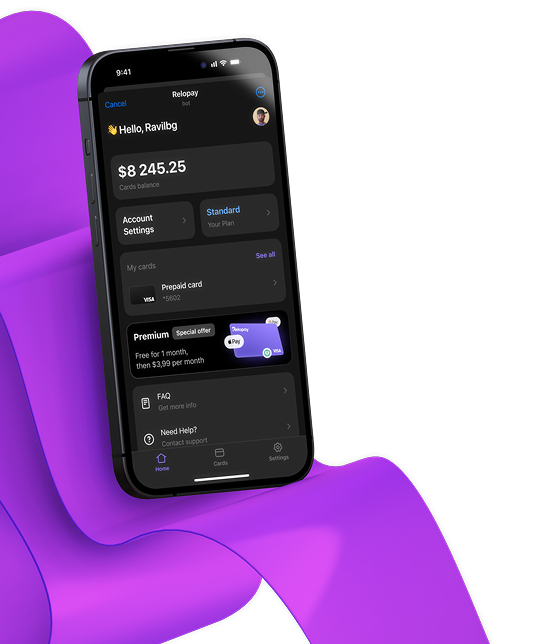

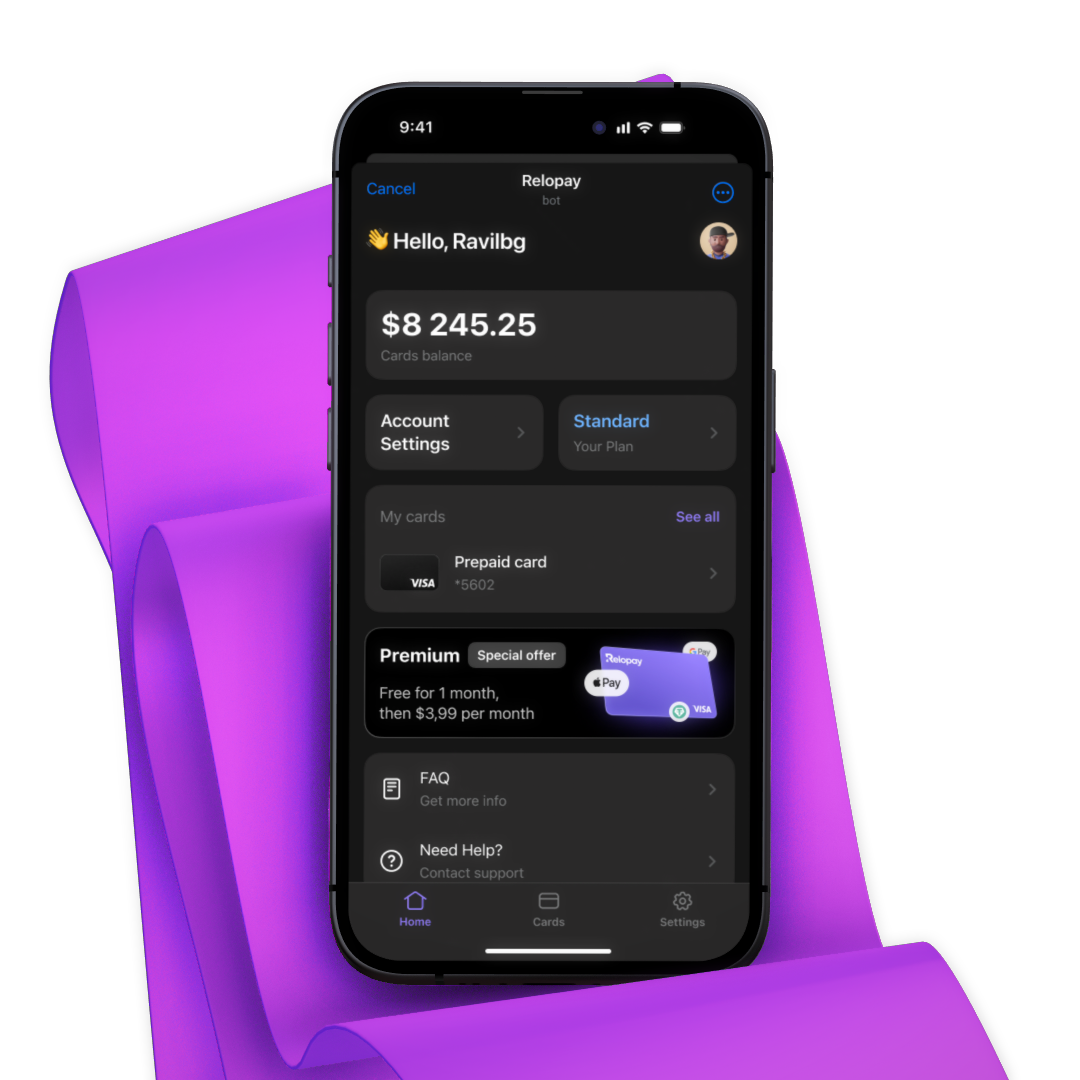

The benefit is control: you spend only your own funds. Relopay supports debit cards via its Telegram mini-app, letting you pay for food, taxis, or online services instantly without manual exchange.

Crypto Credit Cards

What is a crypto credit card? It works like a standard credit card: you spend up to a limit and repay later. The difference is rewards — instead of points, users gain crypto credit card benefits like cashback in Bitcoin or stablecoins. Relopay plans to launch such cards, showing how blockchain can improve payments.

Crypto Prepaid Cards

Prepaid crypto cards have a fixed amount set at order and cannot be reloaded, keeping budgets simple and clear. Each purchase auto-converts into local currency, limited to the set value. Relopay prepaid cards suit online services, subscriptions, travel, or booking Airbnb with crypto.

How Crypto Cards Work

So, what is a crypto card used for? Its role is to transform tokens into everyday purchasing power. Instead of sitting passively in wallets, digital assets become usable in daily life. With Relopay, the process is simple: you choose a card, pass verification if needed, add funds in crypto, and spend instantly with automatic conversion at checkout. Whether for small shopping, services, or travel costs, a crypto card makes payments direct, secure, and truly borderless worldwide.

Account Setup and Verification

Opening a Relopay card is simple go to our Mini-App in Telegram and issue the card you need. Profile data is transferred from Telegram, so there is no classic registration.

Relopay uses Sumsub for fast, secure KYC. Verification may be required for virtual cards or specific services, while prepaid cards usually do not need it. Always use real data, provide valid documents, and note that falsification may lead to suspension.

Funding Your Crypto Card

Relopay cards are managed in Telegram. Balances are in US dollars but can be topped up with Bitcoin, USDT, TRON, Ethereum, BNB, TON, SOL, AVAX, Polygon, and more. Funds are instant. Conversion happens at the card level, so you can pay in euros or yen. The system exchanges automatically, ensuring merchants get the right amount while you spend your asset.

Transaction Process

When you make a purchase, Relopay performs real-time conversion. For example, if a tourist buys coffee abroad, USDT is exchanged instantly and the café receives local currency via Visa. For the shop, it’s a normal card transaction; for the user, it’s crypto in action. A 1.9% crypto-to-fiat conversion fee and a $1 top-up balance fee keep costs low. With Relopay, you can book services, shop online, pay for ChatGPT with crypto, or manage daily expenses worldwide.

Key Benefits and Features

The main reason users choose Relopay is the broad range of crypto card benefits, combining flexibility, convenience, and safety for everyday spending. For those asking what is crypto visa card, the answer is access to global payments, intuitive management, and future cashback rewards that will add even more value. This combination makes Relopay practical for both local use and international travel.

Global Merchant Acceptance

Relopay cards work on Visa networks, accepted by more than 130 million merchants worldwide. From cafés and supermarkets to airlines and e-commerce platforms, users enjoy instant conversion and borderless payments. This makes Relopay ideal for travelers, freelancers, and digital-first workers who need simple and reliable global access.

Rewards and Cashback Programs

Relopay does not yet provide a rewards system, but a crypto cashback feature is under development. Once launched, it will add extra value to payments by returning part of the spending in cryptocurrency. This way, daily purchases will help users grow their digital portfolio. Even small expenses like subscriptions or coffee can generate savings, turning everyday spending into something more rewarding.

Security and Privacy

Relopay protects all activity with advanced encryption and monitoring. Users can track transactions through the dashboard anytime. Unlike suspicious P2P transfers that may trigger blocks, Relopay payments are processed safely. Another advantage is privacy: cards are mostly anonymous, offering more flexibility than named bank cards. This ensures both security and discretion.

Crypto Cards vs Traditional Cards

Crypto cards may look like traditional bank cards, but they differ in key ways:

Funding: traditional cards need a bank account, while Relopay works without one and is funded directly with cryptocurrency.

Currency: banks use manual exchange, while Relopay provides instant real-time conversion at purchase.

Rewards: classic cards give points or miles; Relopay will soon add crypto cashback to improve daily use.

Control: banks manage funds; with Relopay, users stay in charge of their balances.

Currency: banks use manual exchange, while Relopay provides instant real-time conversion at purchase.

Rewards: classic cards give points or miles; Relopay will soon add crypto cashback to improve daily use.

Control: banks manage funds; with Relopay, users stay in charge of their balances.

For everyday spending, Relopay gives faster access. Unlike banks that may take days for cross-border transfers, payments process instantly and work 24/7.

Fees and Considerations

Relopay cards have a simple, transparent fee system designed to be clear for every user. There are no annual charges, a major advantage over many banks. All commissions are stated upfront, so you know what to expect before payment. This openness helps users plan expenses confidently, manage budgets effectively, and avoid hidden costs.

Transaction and Conversion Fees

Relopay cards come with different fee structures depending on the type of card:

- Visa Virtual Cards

Top-up balance — 1%.

Crypto-to-fiat conversion – 1.9%

- Prepaid Cards

Visa Spending Fee — 0%.

This simple and clear system helps users plan expenses confidently. By keeping conversion rates transparent, Relopay makes everyday crypto spending predictable and convenient.

Tax Implications

Relopay cards are virtual and non-personalized, so they are not linked to individual bank accounts. This means that spending with the card does not create tax obligations — users only cover the standard card fees when applicable. For everyday use, this gives you the freedom to manage digital assets as simple payments, without the burden of additional reporting or tax concerns.

Getting Started with Crypto Cards

Getting started with a Relopay card is easy:

- Open the @RelopayBot in Telegram and click “Open App”.

- Choose the card type: Visa Virtual allows balance top-ups, while Visa Prepaid helps you stay within a fixed budget.

- Complete KYC verification if you select a Virtual card.

- Add Bitcoin, USDT, or other supported tokens.

- Start paying instantly at millions of Visa merchants worldwide.

Best practices: always use real data for KYC, review card terms, and hoosing the card that matches your spending needs.

Relopay makes onboarding simple and convenient, giving even new users the confidence to start spending crypto right away.

Frequently Asked Questions

Are crypto cards safe to use?

Yes. Relopay ensures security by protecting all traffic and transactions at a high technical level. This means that even though the cards are simple to use, the system is carefully designed to keep your funds safe. For users wondering what is crypto card safety about, the answer is strong and reliable protection of your payments without complicated steps.

What fees do crypto cards charge?

Relopay makes all fees clear upfront, ensuring users stay fully informed. While what is a crypto card used for may differ from standard bank cards, the approach is consistent — straightforward pricing with no hidden extras. Typical costs include small conversion fees and transaction commissions that vary by card type. This transparency allows users to manage expenses effectively and understand the real cost of each operation in advance.

Do I need to pay taxes on crypto card transactions?

No. Relopay cards are virtual, anonymous, and not tied to named accounts or banks. For users wondering what is bitcoin card taxation, the answer is clear: there are no tax obligations when spending with Relopay. Transactions are treated only as digital payments, and the only costs that may apply are standard card commissions shown transparently.

Can I withdraw cash from ATMs?

No. Relopay cards are for digital spending only. They do not support cash withdrawals or transfers. The balance is used for purchases at millions of merchants, letting users pay for services, shopping, or travel with instant crypto-to-fiat conversion.

What cryptocurrencies are supported?

Currently, Relopay supports Bitcoin, USDT, Ethereum, and other major tokens, with new options added on a regular basis. In addition, you can fund cards with TRON, Binance Coin, Toncoin, Solana, Avalanche, and Polygon. This wide choice ensures flexibility for users and makes it easier to manage spending directly in the cryptocurrency they prefer for everyday payments.

Are there spending limits?

Yes, limits depend on the selected card plan and are shown in the Usage Terms. For Visa Virtual, the monthly limit is $4000, covering most daily and travel expenses. For Prepaid cards, the limit equals the fixed amount chosen at issuance. These rules make budget management simple and clear.

Crypto cards have grown into essential tools linking digital assets with daily spending. They let users pay for groceries, travel, bills, and entertainment directly in crypto. Relopay combines Visa’s global reach, instant conversion, and a simple Telegram mini-app, showing tokens are not just long-term assets but real money for everyday financial freedom.